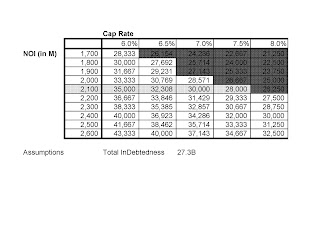

Hi, I just ran a valuation table. My estimate of 2008's NOI is around $2,100M. Ackman has the NOI figure around $2,500. At around $2,100M NOI, the valuation of the firm ranges from $35,000M to $26,250 depending on the cap rate. GGP being a REIT won't want to emerge from this too highly leverage 'coz of the mandatory 90% payout of all earnings, making it really hard to build new equity. Assuming that it comes out with 35% equity and 65% debt as its new capital structure, that would mean that it has to have a cap rate of 5.0% and a Enterprise Value of $42,000M. I think these figures show that Ackman has a rather optimistic point of view of GGP.

Another thing, occupancy rates in terms of commercial property have been continually falling. That should not come as a surprise given the level of unemployment and falling consumption by the general population. All my NOI calculations assume that NOI is stable and does not fall in the interim. Even that might be an overly optimistic assumption.

Although the long term debt stands at $24.3B, the total liabilities stand at around $27.3B. I believe that total indebtedness is a better yard stick than just pure long term debt. 'coz any debt/ liabilities come ahead of equity.

Given my conservative estimates, I don't believe that there is an adequate margin of safety with GGP common stock. I guess I'm going to pass on this one.

No comments:

Post a Comment