I wrote about The9 Limited (NASDAQ: NCTY) last week. I'd just thought I'd give you a update on what I've found after more in-depth research.

1. Investment Thesis

The investment thesis for shorting NCTY is this: NCTY's main business is World of Warcraft (WoW) in China. It recently lost its license to run the game in China. It is spending its remaining cash position to develop new games to generate new revenue. I believe that that is unlikely to occur for the following reasons:

A. These games are very very complex and difficult to program. They take years to build. You can't do it on the fly, burning cash and under pressure from the market to deliver revenue. As it is, most computer games are only delivered years past originally promised completion dates and are notoriously buggy. And for them to have the game gain wide acceptance would take years because consumers need to get accustomed to the game, slowly explore it and recommend it to their friends.

B. They simply don't have the technical capability. NCTY's original function was as a server platform for WoW. They didn't add new functions to the game ie they are not game developers. They wouldn't exist if not for the Chinese gov insistence on having a local entity run these computer games. Blizzard sells WoW to the rest of the world directly without a 3rd party intermediary.

2. Financials

WoW's financial position is actually quite good right now. They are sitting on a US$ 315.5M cash pile right now. Plus US$42M in investments in 4 companies, 9Webzen HK, Object Software, Sunmi Rise and Ideas. The Company invested US$ 3.5M in preferred and common shares in Ideas (a Korean online game developer). NCTY wrote down the US$ 2.1M that they invested in the preferred shares to 0. The Company also invested in a college called Shanghai Institute of Visual Arts (SIVA) a sum of US$1.5M. Their total assets stand at US$ 478.3M as of 31 Dec 2008.

3. Pricing & Valuation

Having said all this, I'm waiting for a rally to around $12 to short the stock. At $8, there is not enough of a margin of safety. The stock did rally to $12 around June for some odd reason. (The announcement for the loss of license was in April.) At $8, their market cap is at USD$240M, which is a 24% discount to their cash value. At $12, their market cap is USD$360M. There is no discount to their cash value and gives us the necessary margin of safety to short the stock.

Extra Data

1. WoW China consists of about 5 million subscribers. The total WoW subscriber base is more than 11.5 million. That means China accounts for about 43% of WoW's subscriber base.

2. NCTY's founder Jun Zhu owns 39.6% of the outstanding stock of NCTY either directly or indirectly as of 31 Dec 2008 from his 13G filings. It is uncertain as to whether he has been selling his stock because the SEC does not require foreign issuers to fill in Form 4s.

3. The reason for the move from NCTY to NetEase is because NetEase agreed to better royalty terms with Blizzard. Wedbush Morgan analyst Michael Pachter thinks that the switch from The9 to NetEase was done for primarily financial reasons: While Blizzard has an estimated 22% royalty rate for WoW income in their partnership with The9 (about 50-55 million USD annually), analysts are predicting that the NetEase agreement would come with royalties of at least 55% - resulting in annual revenue of more than $140 million every year. So switching to NetEase puts approximately $90 million more in Blizzard's pockets every year.

4. The WoW swap from NCTY to NetEase has not been smooth. As of June 7, 2009, WoW has been down in China. It continues to be unavailable in China as of today. There has been rumors that a Beta version of it will be available to existing users July 30, 2009. It is estimated that this will cost Blizzard between US$10 to US$15M.

In my opinion, Blizzard swapping to NetEase is a greed call. They should know that moving from one server to another is always a messy process. For an increase in profits, they cut off more than 43% of their subscriber base for more than 2 months! What are they thinking?! Lost profits aside, they could potentially lose subscribers. Unlike the rest of the world, WoW users in China can play WoW through a prepaid card system. So they are not stuck with a useless monthly subscription. They could easily walk away from the whole thing.

Furthermore, since Blizzard constitutes 91% of NCTY's revenue, I'm sure they could ask for an increase in royalties. I don't quite know what occurred in the negotiations between NCTY and Blizzard. All in all, this is a real big mess.

Hopefully, at least some people can benefit out of it!

Monday, July 27, 2009

Sunday, July 26, 2009

Psychology

Hi,

I've just been reading a lot about psychology, especially in the context of the markets.

http://www.newyorker.com/reporting/2009/07/27/090727fa_fact_gladwell?currentPage=all

The above article by Malcolm Gladwell, talks about how the older and more experienced we get, we overate the accuracy of our judgments. Specifically, he focused on Jimmy Cayne and how he was overly confident and led to the downfall of Bear Stearns.

I've also been reading Contrarian Investment Strategies by David Dreman. There he talks about how analysts tend to psychologically be unable to handle configural/ interactive processing of information. Configural processing of information is processing information with multiple variables which are interdependent and have unknown and unstable relationships with each other. Thus they have a really difficult time coming up with accurate earnings forecasts. Also, how analysts are overly confident with regards to their forecasts, even though statistics show how inaccurate they are. They keep insisting that this time will be different. Or how they didn't have enough information or made some mistake along the way. Dreman suggests that it's not that we don't have enough information. It's the opposite, we have too much. Humans just aren't able to process all that data and come up with an accurate prediction.

Next comes The Psychology of Human Misjudgement by Charlie Munger. It's a paper that Mr Munger writes about human cognitive biases and how they affect our ability to assess different situations.

Finally, Margin of Safety by Seth Klarman, where he talks about humans continually insisting on assessing risks of securities by their past rates of returns/ default rates. We just somehow don't understand the concept that "Past performance is no guarantee of future returns". This line is constantly written in every single prospectus out there but we just don't get it that the past is no guarantee for the future. The future is dynamic and constantly changing.

The most curious thing I found in Margin of Safety was when Mr Klarman talks about CBOs (Collateralized Bond Obligations) and how they were able to convince the rating agencies to give Triple A ratings to 75% of the structure. Basically, CBOs are securitized junk bonds. Doesn't this seem familiar? Doesn't it remind you of the Collateralized Mortgage Obligations (CMOs) and the Collateralized Debt Obligations (CDOs) from our recent past? They spun the same trick of getting the ratings agency to rate most of the structure as triple A as well. The question is how did we manage to fall for the same trick over again? Come on, they barely changed the name! We really don't learn, do we?!

My main worry is this how can I overcome the problems with my cognition?! It's part of me. I can't change it. Worst of all, I don't know where my limits lie. Or when my brain is failing me or it's just simply I didn't do enough homework on the investment. I guess there is no answer as to where our limits lie and how much we should trust our judgment in any given situation. The flip side of the coin is analysis paralysis. We just have to admit that there are some situations where we simply don't/ can't know about - the Unknown Unknowns - as Mr Rumsfeld so eloquently puts it. Guess this makes the game all the more interesting eh?

I've just been reading a lot about psychology, especially in the context of the markets.

http://www.newyorker.com/reporting/2009/07/27/090727fa_fact_gladwell?currentPage=all

The above article by Malcolm Gladwell, talks about how the older and more experienced we get, we overate the accuracy of our judgments. Specifically, he focused on Jimmy Cayne and how he was overly confident and led to the downfall of Bear Stearns.

I've also been reading Contrarian Investment Strategies by David Dreman. There he talks about how analysts tend to psychologically be unable to handle configural/ interactive processing of information. Configural processing of information is processing information with multiple variables which are interdependent and have unknown and unstable relationships with each other. Thus they have a really difficult time coming up with accurate earnings forecasts. Also, how analysts are overly confident with regards to their forecasts, even though statistics show how inaccurate they are. They keep insisting that this time will be different. Or how they didn't have enough information or made some mistake along the way. Dreman suggests that it's not that we don't have enough information. It's the opposite, we have too much. Humans just aren't able to process all that data and come up with an accurate prediction.

Next comes The Psychology of Human Misjudgement by Charlie Munger. It's a paper that Mr Munger writes about human cognitive biases and how they affect our ability to assess different situations.

Finally, Margin of Safety by Seth Klarman, where he talks about humans continually insisting on assessing risks of securities by their past rates of returns/ default rates. We just somehow don't understand the concept that "Past performance is no guarantee of future returns". This line is constantly written in every single prospectus out there but we just don't get it that the past is no guarantee for the future. The future is dynamic and constantly changing.

The most curious thing I found in Margin of Safety was when Mr Klarman talks about CBOs (Collateralized Bond Obligations) and how they were able to convince the rating agencies to give Triple A ratings to 75% of the structure. Basically, CBOs are securitized junk bonds. Doesn't this seem familiar? Doesn't it remind you of the Collateralized Mortgage Obligations (CMOs) and the Collateralized Debt Obligations (CDOs) from our recent past? They spun the same trick of getting the ratings agency to rate most of the structure as triple A as well. The question is how did we manage to fall for the same trick over again? Come on, they barely changed the name! We really don't learn, do we?!

My main worry is this how can I overcome the problems with my cognition?! It's part of me. I can't change it. Worst of all, I don't know where my limits lie. Or when my brain is failing me or it's just simply I didn't do enough homework on the investment. I guess there is no answer as to where our limits lie and how much we should trust our judgment in any given situation. The flip side of the coin is analysis paralysis. We just have to admit that there are some situations where we simply don't/ can't know about - the Unknown Unknowns - as Mr Rumsfeld so eloquently puts it. Guess this makes the game all the more interesting eh?

Thursday, July 23, 2009

GGP Valuation

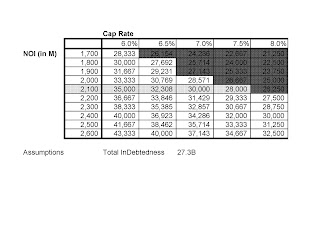

Hi, I just ran a valuation table. My estimate of 2008's NOI is around $2,100M. Ackman has the NOI figure around $2,500. At around $2,100M NOI, the valuation of the firm ranges from $35,000M to $26,250 depending on the cap rate. GGP being a REIT won't want to emerge from this too highly leverage 'coz of the mandatory 90% payout of all earnings, making it really hard to build new equity. Assuming that it comes out with 35% equity and 65% debt as its new capital structure, that would mean that it has to have a cap rate of 5.0% and a Enterprise Value of $42,000M. I think these figures show that Ackman has a rather optimistic point of view of GGP.

Another thing, occupancy rates in terms of commercial property have been continually falling. That should not come as a surprise given the level of unemployment and falling consumption by the general population. All my NOI calculations assume that NOI is stable and does not fall in the interim. Even that might be an overly optimistic assumption.

Although the long term debt stands at $24.3B, the total liabilities stand at around $27.3B. I believe that total indebtedness is a better yard stick than just pure long term debt. 'coz any debt/ liabilities come ahead of equity.

Given my conservative estimates, I don't believe that there is an adequate margin of safety with GGP common stock. I guess I'm going to pass on this one.

Wednesday, July 22, 2009

Financial Engineering, CDOs & Gaussian Copula

I was talking to an old friend last night. Our conversations led to us talking about Collateralized Debt Obligations (CDOs) and Collateralized Mortgage Obligations (CMOs) and the financial crisis. I referred him to this article from Wired Magazine on CDOs, titled Recipe for Disaster: The Formula that killed Wall Street. It does a pretty good job of explaining the CDO problem.

http://www.wired.com/techbiz/it/magazine/17-03/wp_quant?currentPage=all

We were talking about what went wrong and how we got into this state. A lot of the blame has fallen on the quants that created many of these products. Since I have a Masters in Financial Engineering, my buddy asked me if it was true.

My belief is that I think the quants tried their best to come up with pricing and formulas for a lot of the products out there. There are a lot of limitations as to what they understood and could predict. I'm not too sure if they communicated these limitations through to management and the sales team properly. Or if the management just over simplified these limitations or they just ignored it since they couldn't understand it. But somewhere along the line, these limitations were lost. And people took the math as the gospel truth. No where is this more evident than in CDOs.

Just a short summary of the above article for those of you who are interested.

For those of you that are unfamiliar with CDOs (Collateralized Debt Obligations). Basically, CDOs are pools of different types of debt all lumped into one. You have car loans, credit card debt, slices of housing loans (probably bottom tranches of CMOs), etc. You get the idea.

Now Wall Street had a problem - how to price these things? The issue was there was a lack of data on defaults and default correlations of these varied pools of debt. No one knew the historical default data and the correlation rates. So how do we go about pricing them?

Enter David Li. A bright quant working for JP Morgan Chase. He wrote an article called "On Default Correlation - A Copula Function Approach". Li came up with a way to figure out the correlations without historical data. He used these instruments called Credit Default Swaps (CDS). A CDS is a way of insuring your debt. ie if you own a bond or type of debt and you were afraid that the borrower couldn't pay back the debt, you bought a CDS, a kind of default protection. Li reasoned that the CDS of various debt pools/ instruments are a good approximation for historical default rates after all CDS are meant as protection for defaults of those debt pools/ instruments. Li now has a method of pricing CDOs. The formula used to price CDOs is the Gaussian Copula.

The effect was to energize the CDO market. Now people could put a price to these pools of debt, they could sell them or trade with them. They used the formula everywhere. They priced hundreds of billions of dollars of CDOs with it. A lot of the banks realized that the debt was very sensitive to the rise or fall of housing prices. No one put a stop to raised a flag because selling CDOs were so profitable. Furthermore, the managers who were empowered to stop this did not fully understand the math behind the problems and did not fully understand the various arguments.

So we are here today. The housing market blew up. The CDO/ CMO market blew up. Billions lost.

Will we learn from our mistakes? I don't think so. We'll probably make some new variation of the old mistake.

http://www.wired.com/techbiz/it/magazine/17-03/wp_quant?currentPage=all

We were talking about what went wrong and how we got into this state. A lot of the blame has fallen on the quants that created many of these products. Since I have a Masters in Financial Engineering, my buddy asked me if it was true.

My belief is that I think the quants tried their best to come up with pricing and formulas for a lot of the products out there. There are a lot of limitations as to what they understood and could predict. I'm not too sure if they communicated these limitations through to management and the sales team properly. Or if the management just over simplified these limitations or they just ignored it since they couldn't understand it. But somewhere along the line, these limitations were lost. And people took the math as the gospel truth. No where is this more evident than in CDOs.

Just a short summary of the above article for those of you who are interested.

For those of you that are unfamiliar with CDOs (Collateralized Debt Obligations). Basically, CDOs are pools of different types of debt all lumped into one. You have car loans, credit card debt, slices of housing loans (probably bottom tranches of CMOs), etc. You get the idea.

Now Wall Street had a problem - how to price these things? The issue was there was a lack of data on defaults and default correlations of these varied pools of debt. No one knew the historical default data and the correlation rates. So how do we go about pricing them?

Enter David Li. A bright quant working for JP Morgan Chase. He wrote an article called "On Default Correlation - A Copula Function Approach". Li came up with a way to figure out the correlations without historical data. He used these instruments called Credit Default Swaps (CDS). A CDS is a way of insuring your debt. ie if you own a bond or type of debt and you were afraid that the borrower couldn't pay back the debt, you bought a CDS, a kind of default protection. Li reasoned that the CDS of various debt pools/ instruments are a good approximation for historical default rates after all CDS are meant as protection for defaults of those debt pools/ instruments. Li now has a method of pricing CDOs. The formula used to price CDOs is the Gaussian Copula.

The effect was to energize the CDO market. Now people could put a price to these pools of debt, they could sell them or trade with them. They used the formula everywhere. They priced hundreds of billions of dollars of CDOs with it. A lot of the banks realized that the debt was very sensitive to the rise or fall of housing prices. No one put a stop to raised a flag because selling CDOs were so profitable. Furthermore, the managers who were empowered to stop this did not fully understand the math behind the problems and did not fully understand the various arguments.

So we are here today. The housing market blew up. The CDO/ CMO market blew up. Billions lost.

Will we learn from our mistakes? I don't think so. We'll probably make some new variation of the old mistake.

Friday, July 17, 2009

Death of a Business Model: The9Limited (NASDAQ: NCTY)

Some years back, I was asking my prof at Rutgers what to look for in a short? He said simply the death of its business model. My reaction was how in the world to run a stock screen on that? Today I might have just that stock.

The9Limited (NASDAQ: NCTY) is a computer game company. It held the license to run to the world's most popular online Massive Multi-player Online Role Playing Game (MMORPG) - the World of Warcraft (WoW) by Blizzard Entertainment - in China. In April 2009, the company announced that Blizzard will not be renewing its license and has awarded it to another company. WoW accounts for 91% of NCTY's 2008 revenue (from 2008 20-F, pg 29). The license was terminated on June 7, 2009. NCTY's other game franchises include Hellgate: London, Soul of the Ultimate Nation, EA Sports FIFA Online and Granado Espada. None of which approach the size of WoW.

It will be hard for NCTY to replace the revenue because MMORPG's are subject to the network effect. Simply put, the more people in any given network, the greater the ability to draw new people into the network. Other examples are mobile phone networks. What makes MMORPGs so fun is that you get to explore a large online world with your friends, go on quests and campaigns with them or challenge them to fights online. WoW is the largest MMORPG (11.5M subscribers as of Dec 23, 2008). It is really difficult to create a new MMORPG from scratch, reach the critical mass/ level of popularity such that young people will pay for it. These MMORPGs are notoriously complex and hard to create because they aim to create whole new worlds online. Furthermore, it is hard for the game to gain enough acceptance to reach that critical mass.

The company has in the past (2007 20-F) run into accounting issues, specifically inadequate financial controls in its financial reporting, leading its auditor, PWC Shanghai, to explicitly state in NCTY's 2007 20-F. This is really unusual. Normally, the auditor's letter in the 20-F or 10-K will give the company a clean bill of health. Any deviation/ failings from the standard norms should be rectified before it comes to the auditor reporting it in the 20-F. All in all, this does not reflect well on the management.

The stock is down around 40% to 50% from the first announcement in April 2008. Currently, it is trading at $8.45 as of last Friday's close. The price rallied to $12 in June. So there might be opportunities for profit on the short end of this trade. I'd recommend to wait for a rally, then short the stock.

The9Limited (NASDAQ: NCTY) is a computer game company. It held the license to run to the world's most popular online Massive Multi-player Online Role Playing Game (MMORPG) - the World of Warcraft (WoW) by Blizzard Entertainment - in China. In April 2009, the company announced that Blizzard will not be renewing its license and has awarded it to another company. WoW accounts for 91% of NCTY's 2008 revenue (from 2008 20-F, pg 29). The license was terminated on June 7, 2009. NCTY's other game franchises include Hellgate: London, Soul of the Ultimate Nation, EA Sports FIFA Online and Granado Espada. None of which approach the size of WoW.

It will be hard for NCTY to replace the revenue because MMORPG's are subject to the network effect. Simply put, the more people in any given network, the greater the ability to draw new people into the network. Other examples are mobile phone networks. What makes MMORPGs so fun is that you get to explore a large online world with your friends, go on quests and campaigns with them or challenge them to fights online. WoW is the largest MMORPG (11.5M subscribers as of Dec 23, 2008). It is really difficult to create a new MMORPG from scratch, reach the critical mass/ level of popularity such that young people will pay for it. These MMORPGs are notoriously complex and hard to create because they aim to create whole new worlds online. Furthermore, it is hard for the game to gain enough acceptance to reach that critical mass.

The company has in the past (2007 20-F) run into accounting issues, specifically inadequate financial controls in its financial reporting, leading its auditor, PWC Shanghai, to explicitly state in NCTY's 2007 20-F. This is really unusual. Normally, the auditor's letter in the 20-F or 10-K will give the company a clean bill of health. Any deviation/ failings from the standard norms should be rectified before it comes to the auditor reporting it in the 20-F. All in all, this does not reflect well on the management.

The stock is down around 40% to 50% from the first announcement in April 2008. Currently, it is trading at $8.45 as of last Friday's close. The price rallied to $12 in June. So there might be opportunities for profit on the short end of this trade. I'd recommend to wait for a rally, then short the stock.

Wednesday, July 15, 2009

How to do analysis of a company? Part 1

The one thing that really frustrated me at school and at work was the lack of systematic ways of going about doing analysis of companies and industries. I remember asking my professors and my old bosses, so just how do you go about researching a company? What are the things that you need to cover? Meaning critical areas that you need to check into when you research a company and more importantly, how to interpret your findings, what their implications on the stock price and the company performance.

So I decided that I was going to do a series on research and analysis. What are the key things to look at? Where to find them? What do they mean?

First, the financials. Normally, I find companies through my friendly stock screener, either google stock screener or yahoo stock screener. I find both very useful. I key different parameters in and it comes up with a list of companies. Thus the companies I look at already fall within certain parameters in terms of their financials.

First thing I look at is the balance sheet and income statement. I look up the leverage of the company. Debt is neither inherently good nor bad. It's just a form of capital. The company needs to balance its needs to match its current economic situation. Having said that, in the current economic climate, having too much debt is a definitely liability. Especially if its coming due. Companies, like GGP, have gone bankrupt due to their inability to re-finance its debt. Others like Cemex (NYSE: CX) have had their share price greatly depressed due to the overhang of the re-financing question on the company's future.

Bear in mind the absolute amount of debt is only part of the picture. The amount of debt should be thought of in relation to the amount of revenue (long term debt to EBIT or EBITDA etc), debt as a proportion of total capitalization, amount of debt versus equity. All this can be quickly calculated. My rule of thumb is 3.5x EBITDA for an ordinary business (by which I mean manufacturing or simple, non-financial services) is about as high as I am comfortable with. In this current climate, 3.5x is kinda steep. Not because the company can't pay its interest expense but more because some of that debt will probably not be able to re-finance if it comes due. Having said that, there are some industries like utilities that operate consistently with very high leverage (6 or 7 times EBITDA) and have no issues. But they are more often the exception.

After that I look at revenue trends. Is it going up? Or is it going down? Are there any large jumps in revenue? Why is that so? Did they acquire another company? Do they consistently keep buying companies? Does that result in an increase in net profit margins?

There are a number of companies out there that are serial acquirers. Esp during times when credit is cheap. Most often their acquisitions fail to deliver the goods. I've realized that big acquisitions are really hard to pull off successfully. It's often easier to do small acquisitions and integrate them well. A good example of a serial acquirer that adds value is Danaher (NYSE: DHR). These guys have a dedicated team that conducts M&A. They have a whole business system set up around acquiring companies and integrating them into DHR. They are very meticulous and stick to their knitting. They don't venture out of their space. They acquire only specialty instrument companies. That's their niche and they are very good at it. However, DHR is the exception, rather than the rule. Most companies don't have the discipline to acquire businesses that they understand or the setup to integrate their acquisitions. And so they should just not do it.

One more point, where would I find all these financials? A good starting point is yahoo finance. I don't trust the numbers absolutely, there are sometimes mistakes. But it's a good starting point. The reason it's good is 'coz all the stats and ratios are contained in the key stats tab. Later, I go to the Edgar website for the 10Ks and 10Qs. Another good place is the company website. Often the company has the 10Ks and 10Qs in pdf format, so I go there and download them. It's a lot easier to read and I can save it on my computer.

I'll post more on research and analysis as we go on. Hope you enjoy reading this blog.

If you have any suggestions, case studies or ideas. Please feel free to tell me (shaunhhh@gmail.com).

PS. A good book I found on equity analysis is "The Art of Short Selling" by Kathryn F. Staley. It gives a good thorough, all bases covered look at equity analysis. 'coz you often have to be more cautious and thorough when you are short a stock.

Another good book is the Interpretation of Financial Statements by Benjamin Graham. This one is shorter and more of an introduction. It's a classic though.

So I decided that I was going to do a series on research and analysis. What are the key things to look at? Where to find them? What do they mean?

First, the financials. Normally, I find companies through my friendly stock screener, either google stock screener or yahoo stock screener. I find both very useful. I key different parameters in and it comes up with a list of companies. Thus the companies I look at already fall within certain parameters in terms of their financials.

First thing I look at is the balance sheet and income statement. I look up the leverage of the company. Debt is neither inherently good nor bad. It's just a form of capital. The company needs to balance its needs to match its current economic situation. Having said that, in the current economic climate, having too much debt is a definitely liability. Especially if its coming due. Companies, like GGP, have gone bankrupt due to their inability to re-finance its debt. Others like Cemex (NYSE: CX) have had their share price greatly depressed due to the overhang of the re-financing question on the company's future.

Bear in mind the absolute amount of debt is only part of the picture. The amount of debt should be thought of in relation to the amount of revenue (long term debt to EBIT or EBITDA etc), debt as a proportion of total capitalization, amount of debt versus equity. All this can be quickly calculated. My rule of thumb is 3.5x EBITDA for an ordinary business (by which I mean manufacturing or simple, non-financial services) is about as high as I am comfortable with. In this current climate, 3.5x is kinda steep. Not because the company can't pay its interest expense but more because some of that debt will probably not be able to re-finance if it comes due. Having said that, there are some industries like utilities that operate consistently with very high leverage (6 or 7 times EBITDA) and have no issues. But they are more often the exception.

After that I look at revenue trends. Is it going up? Or is it going down? Are there any large jumps in revenue? Why is that so? Did they acquire another company? Do they consistently keep buying companies? Does that result in an increase in net profit margins?

There are a number of companies out there that are serial acquirers. Esp during times when credit is cheap. Most often their acquisitions fail to deliver the goods. I've realized that big acquisitions are really hard to pull off successfully. It's often easier to do small acquisitions and integrate them well. A good example of a serial acquirer that adds value is Danaher (NYSE: DHR). These guys have a dedicated team that conducts M&A. They have a whole business system set up around acquiring companies and integrating them into DHR. They are very meticulous and stick to their knitting. They don't venture out of their space. They acquire only specialty instrument companies. That's their niche and they are very good at it. However, DHR is the exception, rather than the rule. Most companies don't have the discipline to acquire businesses that they understand or the setup to integrate their acquisitions. And so they should just not do it.

One more point, where would I find all these financials? A good starting point is yahoo finance. I don't trust the numbers absolutely, there are sometimes mistakes. But it's a good starting point. The reason it's good is 'coz all the stats and ratios are contained in the key stats tab. Later, I go to the Edgar website for the 10Ks and 10Qs. Another good place is the company website. Often the company has the 10Ks and 10Qs in pdf format, so I go there and download them. It's a lot easier to read and I can save it on my computer.

I'll post more on research and analysis as we go on. Hope you enjoy reading this blog.

If you have any suggestions, case studies or ideas. Please feel free to tell me (shaunhhh@gmail.com).

PS. A good book I found on equity analysis is "The Art of Short Selling" by Kathryn F. Staley. It gives a good thorough, all bases covered look at equity analysis. 'coz you often have to be more cautious and thorough when you are short a stock.

Another good book is the Interpretation of Financial Statements by Benjamin Graham. This one is shorter and more of an introduction. It's a classic though.

Thursday, July 2, 2009

GGP Update 2

Hi I've just been going through the GGP bankruptcy docs. I think there are some important points that it makes. It's incredible that GGP is in bankruptcy. Basically, the whole CMBS market froze up and the company was unable to re-finance its debt as it came due. It is still able to pay its interest obligations. In fact, as a show of good faith it has decide to continue paying its interest expense at contractually agreed rates. This shows confidence in the strength of cash flow from shopping centers and other ops. Considering that they are in bankruptcy, it's quite unprecedented that they are paying interest at all. So it wasn't that the company's previous management was incompetent. It's more a question of unprecedented closure of a multi-billion market that they counted on for re-financing.

To answer previous queries about a possible fire sale of all the properties. Apparently, GGP's CEO doesn't think it likely 'coz the potential buyers are going to have problems getting financing. In my opinion, this is true to a certain extent. It might be true now. But as the credit markets start to unfreeze, this will start to change. In fact, I read today in the Journal that Apollo Management and Angelo Gordon might be venturing into REITs. So while the possibility of a fire sale is low right now, it cannot be ruled out in the future. However, the flip side is also true. If others can raise financing, GGP might be able to raise debt to refinance its current obligations.

My final point is that while the current management has cut GGP's capex to $224M from $1.5B for 2009 and from $1.3B to $108M in 2010. Unlike Pershing Sq, I don't believe that this is sustainable for any period of time more than past 2010. The malls need regular face lifts, upgrades and extensive re-investment to keep the public continually coming back to them. If these things are neglected for too long, I do believe this will start to destroy the value of the business. So GGP needs to get itself out of bankruptcy as soon as possible, lest it destroy the value of its assets through neglect.

Here's a summary of GGP's CEO Adam Metz's and restructuring firm, Alix Partner's James Mesterharm's declaration.

"1. GGP’s 2008 company-wide net operating income (NOI), was $2.59 billion, an increase of 4.5 percent over 2007 despite the challenges of the economy.

2. This increase is because the shopping center business is very different from the retail business. GGP’s business is far less cyclical than that of the retail industry because our revenues are insulated by long-term leases, tenant diversity, and the geographic and demographic diversity of our properties.

3. GGP continues to have occupancy rates above 90% - among the highest in the industry – and even now GGP is regularly are entering into new leases with existing and new tenants. As of Dec 31, 2008, GGP Group had 92.5% of its mall and freestanding space leased, and its average lease term was greater than nine years.

4. GGP's resilience to the economic downturn is due to several factors.

- GGP’s shopping centers are well-located and often the leading properties in their respective markets.

- GGP's tenant base is high caliber and well diversified, with no tenant making up more than three percent of our revenues.

- Competition from new shopping malls is likely to be limited in the future because there is no financing available for new developments, and it is extraordinarily difficult to obtain approvals to build competing properties even when financing is available.

- Finally, GGP also has valuable development rights associated with many of its properties, assets which do not generate cash today but in the future have the potential to create enormous value.

5. GGP has sought bankruptcy court assistance to restructure its finances and de-leverage its balance sheet because the collapse of the credit markets has made it impossible for the company to refinance its maturing debt outside of chapter 11.

- the commercial real estate finance markets have ceased to function and effectively are closed, even for loans on quality properties generating stable income. The reasons for this are unrelated to the performance of the shopping center industry generally.

6. GGP has approximately $18.4 billion in outstanding debt obligations that have matured or will mature between now and the end of 2012, including past due maturities of $2.0 billion, $1.3 billion more coming due in the remainder of 2009, and $6.4 billion in 2010.

As of December 31, 2008, the GGP Group as a whole reported approximately $29.6 billion in total assets and approximately $27.3 billion in total liabilities (including the GGP Group’s proportionate share of joint venture indebtedness). Of the $27.3 billion in total liabilities, $24.85 billion represents the aggregate consolidated outstanding indebtedness of consolidated entities, which includes $6.58 billion in unsecured, recourse indebtedness and $18.27 billion in debt secured by properties. For 2008, the GGP Group reported consolidated revenue of approximately $3.4 billion.

7. GGP borrow mortgage loans with low amortizing three to seven year terms, improve the NOI for the property through the company’s operational and management expertise, and refinance those loans at maturity, a model used successfully in the commercial real industry for decades.

8. Default occurred cause on Jan 1, 2009 to the date of the chapter 11 filing, $1.1 billion of additional debt has matured which the company is unable to refinance. GGP’s inability to refinance debt as it matured triggered acceleration of $4.1 billion in debt that otherwise was not currently due.

9. In total, as of the chapter 11 filing GGP had approximately $2.0 billion of past-due indebtedness and an additional $5.9 billion that has been or is subject to acceleration. Another $1.3 billion will mature by its own terms later in 2009. Another $1.3 billion will mature by its own terms later in 2009. GGP has virtually no hope of refinancing either its past-due debts or its upcoming maturities in the current credit markets.

10. GGP tried to re-negotiate the maturing CMBS loans but were unable to because of the constraints on the master servicers and special servicers ability to re-negotiate loans.

11. GGP undertakes many measures to increase short-term liquidity.

- GGP suspends its dividends

- GGP reduced their planned spending for development and redevelopment of properties from $1.5B to $224M for 2009, and from $1.3B to $108 million for 2010. These are capex relating to expansion and redev of shopping malls.

12. GGP ability to divest assets is severely limited because prospective buyers also have limited or no ability to finance acquisitions. GGP was only able to sell one parcel of land, two office parks, and three office buildings in 2008. All but one of these sales closed prior to the 4th quarter of 2008.

13. Pershing Square Capital is the agent of GGP’s DIP financing. PS Green Holdings and PS Green Inc as initial lenders of the DIP facility. DIP facility’s interest rate is at LIBOR plus 12%.

14. GGP has proposed to pay its mortgage lenders amounts equal to contract-rate interest payments during the chapter 11 cases."

To answer previous queries about a possible fire sale of all the properties. Apparently, GGP's CEO doesn't think it likely 'coz the potential buyers are going to have problems getting financing. In my opinion, this is true to a certain extent. It might be true now. But as the credit markets start to unfreeze, this will start to change. In fact, I read today in the Journal that Apollo Management and Angelo Gordon might be venturing into REITs. So while the possibility of a fire sale is low right now, it cannot be ruled out in the future. However, the flip side is also true. If others can raise financing, GGP might be able to raise debt to refinance its current obligations.

My final point is that while the current management has cut GGP's capex to $224M from $1.5B for 2009 and from $1.3B to $108M in 2010. Unlike Pershing Sq, I don't believe that this is sustainable for any period of time more than past 2010. The malls need regular face lifts, upgrades and extensive re-investment to keep the public continually coming back to them. If these things are neglected for too long, I do believe this will start to destroy the value of the business. So GGP needs to get itself out of bankruptcy as soon as possible, lest it destroy the value of its assets through neglect.

Here's a summary of GGP's CEO Adam Metz's and restructuring firm, Alix Partner's James Mesterharm's declaration.

"1. GGP’s 2008 company-wide net operating income (NOI), was $2.59 billion, an increase of 4.5 percent over 2007 despite the challenges of the economy.

2. This increase is because the shopping center business is very different from the retail business. GGP’s business is far less cyclical than that of the retail industry because our revenues are insulated by long-term leases, tenant diversity, and the geographic and demographic diversity of our properties.

3. GGP continues to have occupancy rates above 90% - among the highest in the industry – and even now GGP is regularly are entering into new leases with existing and new tenants. As of Dec 31, 2008, GGP Group had 92.5% of its mall and freestanding space leased, and its average lease term was greater than nine years.

4. GGP's resilience to the economic downturn is due to several factors.

- GGP’s shopping centers are well-located and often the leading properties in their respective markets.

- GGP's tenant base is high caliber and well diversified, with no tenant making up more than three percent of our revenues.

- Competition from new shopping malls is likely to be limited in the future because there is no financing available for new developments, and it is extraordinarily difficult to obtain approvals to build competing properties even when financing is available.

- Finally, GGP also has valuable development rights associated with many of its properties, assets which do not generate cash today but in the future have the potential to create enormous value.

5. GGP has sought bankruptcy court assistance to restructure its finances and de-leverage its balance sheet because the collapse of the credit markets has made it impossible for the company to refinance its maturing debt outside of chapter 11.

- the commercial real estate finance markets have ceased to function and effectively are closed, even for loans on quality properties generating stable income. The reasons for this are unrelated to the performance of the shopping center industry generally.

6. GGP has approximately $18.4 billion in outstanding debt obligations that have matured or will mature between now and the end of 2012, including past due maturities of $2.0 billion, $1.3 billion more coming due in the remainder of 2009, and $6.4 billion in 2010.

As of December 31, 2008, the GGP Group as a whole reported approximately $29.6 billion in total assets and approximately $27.3 billion in total liabilities (including the GGP Group’s proportionate share of joint venture indebtedness). Of the $27.3 billion in total liabilities, $24.85 billion represents the aggregate consolidated outstanding indebtedness of consolidated entities, which includes $6.58 billion in unsecured, recourse indebtedness and $18.27 billion in debt secured by properties. For 2008, the GGP Group reported consolidated revenue of approximately $3.4 billion.

7. GGP borrow mortgage loans with low amortizing three to seven year terms, improve the NOI for the property through the company’s operational and management expertise, and refinance those loans at maturity, a model used successfully in the commercial real industry for decades.

8. Default occurred cause on Jan 1, 2009 to the date of the chapter 11 filing, $1.1 billion of additional debt has matured which the company is unable to refinance. GGP’s inability to refinance debt as it matured triggered acceleration of $4.1 billion in debt that otherwise was not currently due.

9. In total, as of the chapter 11 filing GGP had approximately $2.0 billion of past-due indebtedness and an additional $5.9 billion that has been or is subject to acceleration. Another $1.3 billion will mature by its own terms later in 2009. Another $1.3 billion will mature by its own terms later in 2009. GGP has virtually no hope of refinancing either its past-due debts or its upcoming maturities in the current credit markets.

10. GGP tried to re-negotiate the maturing CMBS loans but were unable to because of the constraints on the master servicers and special servicers ability to re-negotiate loans.

11. GGP undertakes many measures to increase short-term liquidity.

- GGP suspends its dividends

- GGP reduced their planned spending for development and redevelopment of properties from $1.5B to $224M for 2009, and from $1.3B to $108 million for 2010. These are capex relating to expansion and redev of shopping malls.

12. GGP ability to divest assets is severely limited because prospective buyers also have limited or no ability to finance acquisitions. GGP was only able to sell one parcel of land, two office parks, and three office buildings in 2008. All but one of these sales closed prior to the 4th quarter of 2008.

13. Pershing Square Capital is the agent of GGP’s DIP financing. PS Green Holdings and PS Green Inc as initial lenders of the DIP facility. DIP facility’s interest rate is at LIBOR plus 12%.

14. GGP has proposed to pay its mortgage lenders amounts equal to contract-rate interest payments during the chapter 11 cases."

Subscribe to:

Posts (Atom)