France Telecom Debt Alert

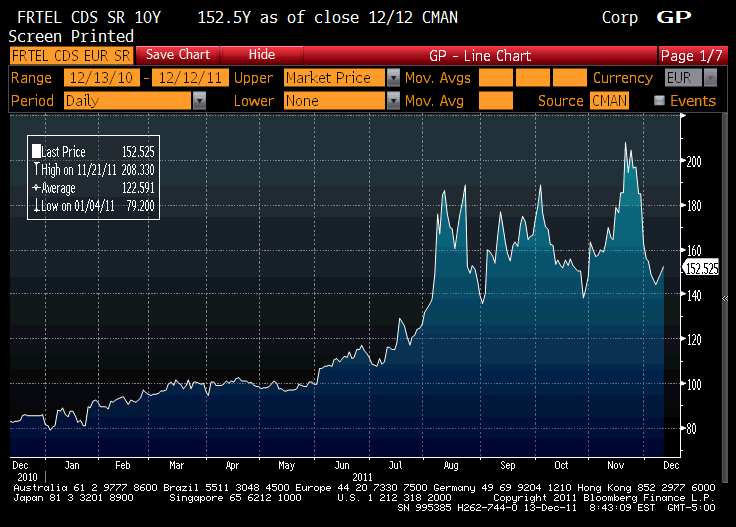

Just an update on France Telecom (FTE). I just read this article from Bloomberg on FTE's CDS spiking (date 25 Nov 2011). FTE's CDS apparently spiked to 182 basis points (bps), reflecting the market's fear of FTE's possibilty of default. The good news is that despite the spike FTE's CDS spread was still less than the French government's bond CDS, which hit an all time high of 249bps.

I just checked the CDS on FTE's 10 year bond today on Bloomberg. It's back down to 152bps.

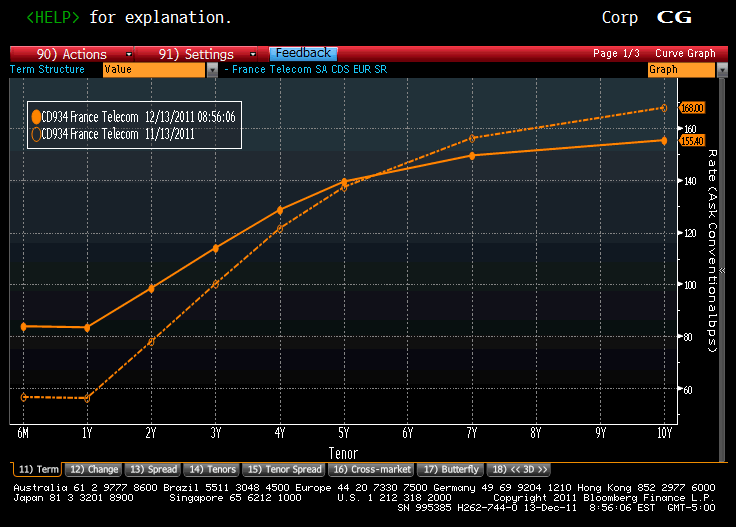

However, when I compared the total CDS spread curve for FTE with 1 month back. Things aren't that great. The short end of the curve has hiked from 60+ bps to 80+bps. That translates into higher short term funding costs for FTE.

None of this is desperately dire for FTE but it does reflect the CDS market's concern about FTE's debt load. The good thing is that FTE only has 8.15% (Euro 2.7B) of its debt coming up for re-financing in 2012. So the increase in interest expense should be tolerable.

All in all, my opinion is that there is the CDS spike should not be cause for concern.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment